Home »

News & Knowledge » Compensation limits – Will the FSCS increase them for pensions in line with the Financial Ombudsman Services increase?

If you have been provided with negligent financial advice, you can make a complaint to the Financial Ombudsman Service (FOS) or to the Financial Services Compensation Scheme (FSCS) for compensation.

This is to try and recover any losses that you have suffered and to put you back in the position you would have been in if you had not received the negligent advice from the advisor.

The Financial Ombudsman Service

The Financial Ombudsman Service have recently increased the compensation award limit for complaints referred to them on or after the 1st of April 2022 about acts or omissions by firms that have provided negligent advice about pensions to customers. This compensation award limit is automatically adjusted each year in line with inflation as measured by the Consumer Prices Index (‘CPI’).[1]

The award limit has been increased to £375,000, which was previously £350,000, for complaints about acts or omissions by firms on or after the 1st of April 2019. For complaints about acts or omissions by firms before the 1st of April 2019, the award limit has been increased to £170,000, which was previously £150,000.

The Financial Services Compensation Scheme

The FSCS is a statutory UK compensation scheme to protect customers of financial services. The FSCS is calling for the compensation award limit for complaints made to them to be reviewed for miss-sold pension claims in line with the FOS increase.

Currently, the FSCS’s compensation award limit for negligent advice from a firm that was declared in default after the 1st of April 2019 is capped at £85,000 per person. If the complaint is about a firm that was declared in default on or before the 1st of April 2019 the award limit is capped at £50,000 per person.[2]

This means that the FOS can award a significant higher amount in compensation compared to the FSCS.

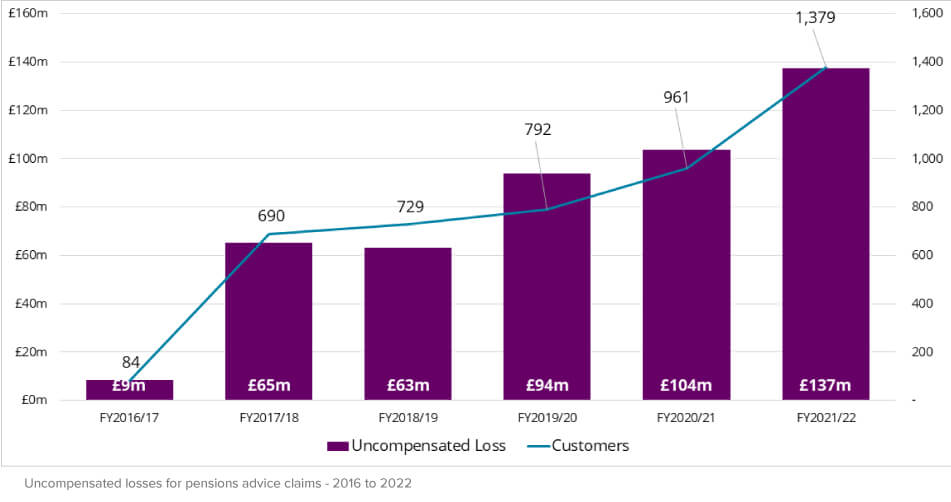

The below chart shows the compensation limit changes from 2001 to 2022.

The FSCS’s Chief Executive Caroline Rainbird stated pensions is an area that needs highlighting in relation to compensation funding by the FSCS. Caroline Rainbird also stated “the scale of the financial loss experienced by many consumers in this area highlights the impact the current compensation limit has on our ability to put people back on track, leaving many with pension shortfalls.”[3]

In the recent paper The Balancing Act of Compensation published by the FSCS in May 2022, the FSCS said it believes that their current compensation limits remain appropriate for most products and activities it covers but it needs to be higher when it comes to pension claims.

The FSCS states that there is an important exception when it comes to pensions so they would like to see the compensation award limit to be reviewed with a view to reduce the gap between their limit and the amount that can be awarded by the FOS.[4]

Emma Barrow, the FSCS’s Head of Communications said: “I think consumers would much rather deal with a different limit for pensions, than face into a future where their retirement is no longer secure through no fault of their own, which is something we’re sadly seeing every day with the limit as it is.

“It feels unfair that two people in virtually identical circumstances could receive radically different levels of compensation just because one dealt with a firm that has since failed.”

The impact due to the FSCS’s award limits

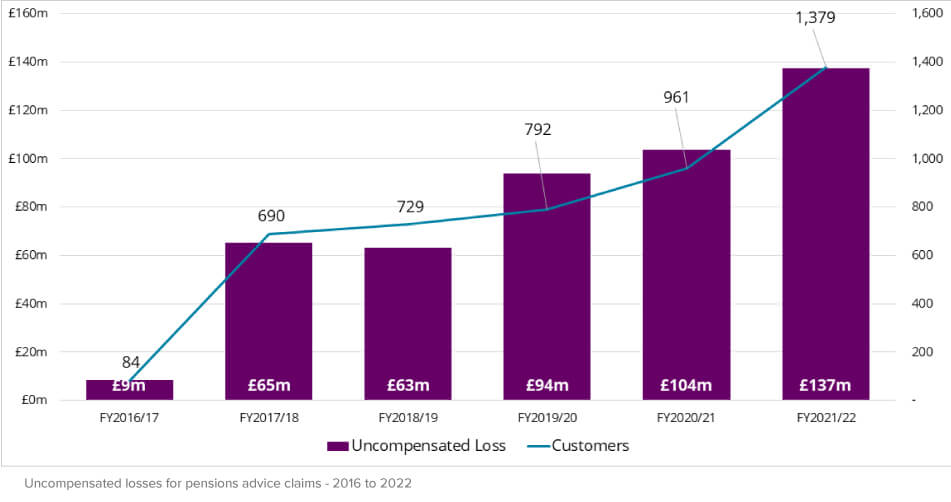

There is a big impact on customers due to the award limits as in some cases the amount they can award is less than the total amount the customer has lost. For pension advice claims, the rise in uncompensated loss has been far steeper and the average uncompensated loss per customer is far greater than the average across all claim types.

The FSCS’s Head of Resolution Simon Wilson stated:

“The total number of claims where the customers loss was over the relevant limit was almost 3,600 in the 2021/22 financial year that has just ended. This number has risen steadily over the past six years and in that period has resulted in just short of £1 billion in loss not being paid back to customers as compensation.”

The below chart shows uncompensated losses for pension advice claims from 2016 to 2022.

Making a claim

Oakwood Solicitors has acted on behalf of many clients in relation to miss-sold pension claims and we may be able to offer our services on a no-win, no-fee basis.

Further reading

Mis-sold pensions – Oakwood Solicitors

Financial Services Compensation Scheme

WHAT TO DO NEXT

Get in touch today for a no-obligation consultation. Choose one of the methods on the right-hand side of this page, or call us on 0113 200 9720 to find out how we can help you.

Stephanie Gardiner joined Oakwood Solicitors in 2018 as a new enquiry handler after completing her Law Degree and graduating from Leeds Beckett University in 2017.

In 2022, Stephanie joined the Fin…

Will the FSCS increase their compensation limits for pensions in line with the Financial Ombudsman Services increase?

Contract for Differences – Case Study

After successfully bringing a Claim for a Financial Litigation Client, we share a case study of the process.

Contract For Differences

Mrs. X was approached…

View

The 35-Hour Working Week

At present, a large number of employees across the United Kingdom are essentially overworked, and underpaid. It is also becoming more apparent that working families are struggling to keep up with …

View

Can I make a claim against Stirling Mortimer?

If you have been provided with negligent financial advice, you can make a complaint to the Financial Ombudsman Service (FOS) or to the Financial Services Compensation Scheme (FSCS) for compensation. This is to try and recover any losses that you have suffered and to put you back in the position you would have been…

View