The rise of sophisticated fraudsters and scams is causing significant financial and emotional distress, making it crucial to be aware of scam tactics and understand that victims may have legal avenues to recover lost money.

Oakwood Solicitors understands the huge, negative impact of scams and offers assistance to help victims recover funds lost as a result of fraud.

Common Types of Fraud and Scams

Scammers employ various tactics to lure you into parting with your money under false pretences. Knowing the types of scams can help you spot the danger:

- Authorised Push Payment (APP) Fraud: Tricking victims into sending money directly from their bank account to a fraudster’s account.

- Impersonation Scams: Fraudsters posing as trusted organisations such as banks, the government (like HMRC), or the police to obtain personal information or money.

- Investment Scams: Deceptive schemes offered with the promise of an unrealistically high return on investment.

- Cryptocurrency Scams: Theft of money through fraudulent schemes involving digital currencies.

- Advanced Fee Scams: Duping victims into paying up front for services, loans, or goods that never materialise.

- Purchase Scams: Fake sellers tricking victims into paying for non-existent goods or items that are never delivered.

- Romance Scams: Online scammers building a false relationship to persuade targets into sending money.

How to Spot a Scam

It can be difficult to know if you’re a victim, as scams can appear very genuine. However, you should be suspicious if:

- It seems too good to be true: For example, an investment promises guaranteed high returns or a product is significantly cheaper than expected.

- Someone you don’t know contacts you unexpectedly: This could be by phone, email, text, or social media.

- You are pressured into making a decision quickly: Scammers often create a false sense of urgency or fear to prevent you from thinking clearly.

- The company lacks clear or available contact details: This suggests the organisation you are dealing with is not legitimate.

- You are asked to provide private personal information: Be extremely cautious about sharing passwords, PINs, or sensitive financial data.

Can I Get My Money Back?

Yes, there are options available to recover your money.

Recovery of funds can be sought from the financial institution (e.g., your bank) which may have failed in its duty to prevent the fraud. Banks have obligations to protect customers, and if they missed signs that should have triggered a warning or block, they may be liable to return the funds.

In some instances, other regulated firms involved in the transaction may have also failed to detect the fraud and issue a warning, opening up additional recovery avenues.

While you can attempt to recover the funds yourself, instructing a specialist legal representative, such as Oakwood Solicitors, offers key benefits:

- Expertise: We are a regulated firm with over 20 years’ experience in financial mis-selling claims.

- Hassle-Free Process: We aim to take the stress out of the claims process by handling all the complex legal work for you.

Frequently Asked Questions:

Are there any upfront costs to pursue a claim?

Oakwood Solicitors operates on a Damages Based Agreement (DBA), more commonly known as a No Win No Fee Agreement. This means:

- There are no upfront fees to pursue a claim.

- If the claim is unsuccessful, you will not be charged.

- Our fees only become payable upon receiving a successful settlement.

What are your fees if your claim is successful?

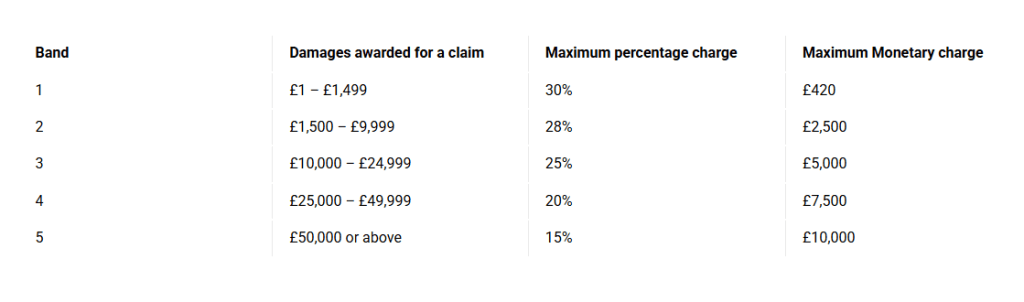

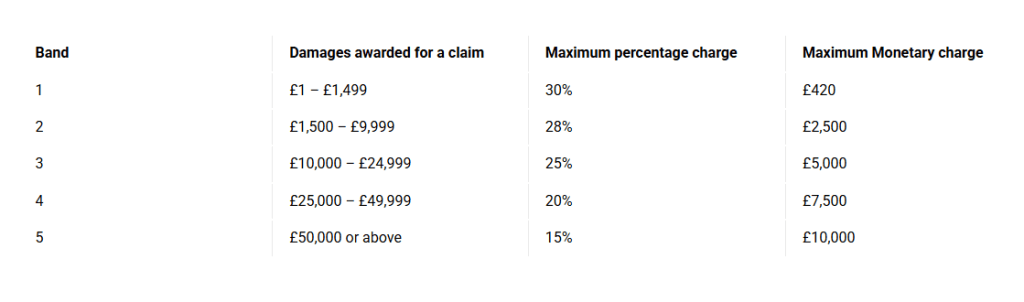

The Solicitors Regulation Authority (SRA) regulates the fees a Solicitor can charge for this area of work. Our fee is limited to a maximum percentage rate or a maximum total monetary charge, whichever is lower, with the specifics determined by the amount of damages received.

Note: The maximum percentage rate and maximum total charge are exclusive of VAT, which is charged at the prevailing rate (currently 20%) in addition.

Can I make a claim if I have already complained to the bank?

Yes. If your bank has already rejected your complaint, there are still legal options available to you.

It is essential to obtain legal advice as soon as possible, as some of these legal options have strict time limits. Don’t delay, contact a specialist today to discuss your case.

Why choose Oakwood Solicitors?

Oakwood Solicitors have a dedicated department of specialise lawyers who have knowledge and experience of bank fraud and scams. As the scams become increasingly more sophisticated, and the fraudsters become harder to detect, it is important to have the right people on your side to ensure that you have the best chance of recovering your money.

Oakwood Solicitors are experts. They understand the legal and regulatory frameworks surrounding bank fraud and scams. We will offer you advice, guidance and support in using all the legal and regulatory framework to maximise your chances of successfully recovering your money, and doing so in the most time efficient way.

We take the hassle out of the claims process as we do all the hard work for you. You will be allocated your own experienced claims handler who will keep you fully informed throughout the process.

Further information:

Have you lost money because of a bank fraud or scam?

WHAT TO DO NEXT

If you have lost Money to a Bank Fraud or Scam, get in touch today for a no-obligation consultation.

Choose one of the methods on the right-hand side of this page or call us on 0113 323 2391 to find out how we can help you.

Download PDF

Danielle Lightfoot is a Director and our Head of the Financial Litigation Department. Danielle joined the firm as a Paralegal in 2011 and qualified as a solicitor in October 2014. She has acquired ext…

We would love to hear your comments or feedback

Romance Scams – What are they?

Romance scams usually begin on dating apps or social media sites. Scammers use these online profiles to create fake identities or impersonate real celebrities to get close to their targets.

…

View